Renters Insurance in and around Benton

Welcome, home & apartment renters of Benton!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your things are important; keeping them secure should be just as important. Doing what you can to keep it safe just makes sense! Your next right step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your desk to your video games. Unsure how to choose a level of coverage? That's okay! Whitney Owens stands ready to help you assess your needs and help select the right policy today.

Welcome, home & apartment renters of Benton!

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Whitney Owens can help you build a policy for when the unanticipated, like an accident or a fire, affects your personal belongings.

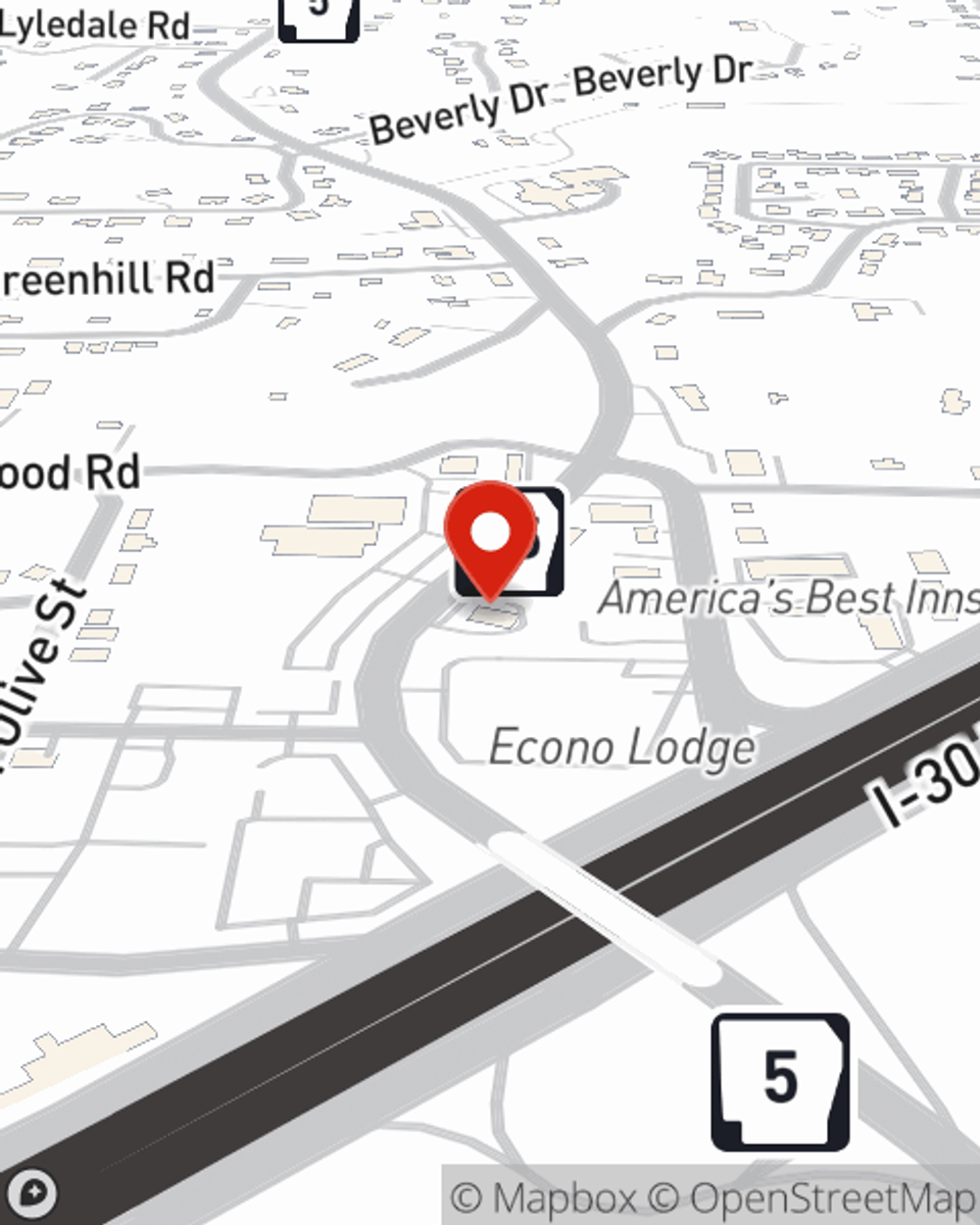

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Benton. Call or email agent Whitney Owens's office to learn more about a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Whitney at (501) 315-6639 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Whitney Owens

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.